Recent Posts

- March, 2024

Dressing for all day comfort – embracing technical fabrics and innovative designs

- December, 2023

The power of feedback

- November, 2023

Comfortable uniforms – it’s all about the fabric

- October, 2023

Launching our first Uniformity e-book

- September, 2023

Our commitment to social and environmental sustainability as a Sedex member

Did you know that non-compulsory uniform sets entered under the TCF Corporatewear Register offer potential tax benefits?

With tax time around the corner, we thought it would be helpful to define what uniform sets classify as non-compulsory, the eligibility criteria for registration and how your business can apply.

According to the Income Tax Assessment Act 1997, the taxation law only allows a deduction to employees for expenditure on uniforms or wardrobes where either:

a) the clothing is occupation specific or protective clothing,

b) the wearing of the clothing is a compulsory condition of employment for employees and the clothing is not conventional in nature (compulsory occupational clothing),

c) where the wearing of the clothing is not compulsory, and the design of the clothing is entered on the Register of Approved Occupational Clothing (the Register).

To understand option c, we must define what forms a non-compulsory uniform and what the Register of Approved Occupational Clothing entails.

As explained on business.gov.au, any employer in Australia can undergo the free registration process of their non-compulsory corporate uniform and accessories in the Textile, Clothing and Footwear (TCF) Corporatewear Register.

A non-compulsory corporate uniform is a set of clothing and accessory items that:

- distinctly identifies a particular employer, product, or service, AND

- isn’t compulsory for employees to wear to work.

Therefore, clothing that is ineligible under the TCF Register includes:

- compulsory uniforms

- occupation-specific clothing such as chef’s check pants and white shirt

- protective clothing.

So what are the benefits of registering?

There are “potential” benefits for the employer AND the employee.

- If your business employs staff and they wear a non-compulsory uniform, you may be eligible to avoid paying fringe benefit tax (FBT) on any contributions you make towards the uniform

- Your employees are also eligible for tax deductions for expenses incurred in the rental, purchase, or maintenance of approved non-compulsory occupational clothing too. As always, the Australian Taxation Office (ATO) determines the level of tax deductions.

But there are some important considerations surrounding eligibility.

There are strict qualification criteria in place to determine if non-compulsory uniforms meet the Approved Occupational Clothing Guidelines and thus can qualify for the TCF Corporatewear Register.

Firstly, the uniform MUST be a complete outfit such as dress or shirt with trousers, shorts and/or skirt. Two other key criteria points are around colour choice and brand identifiers.

Colour choice

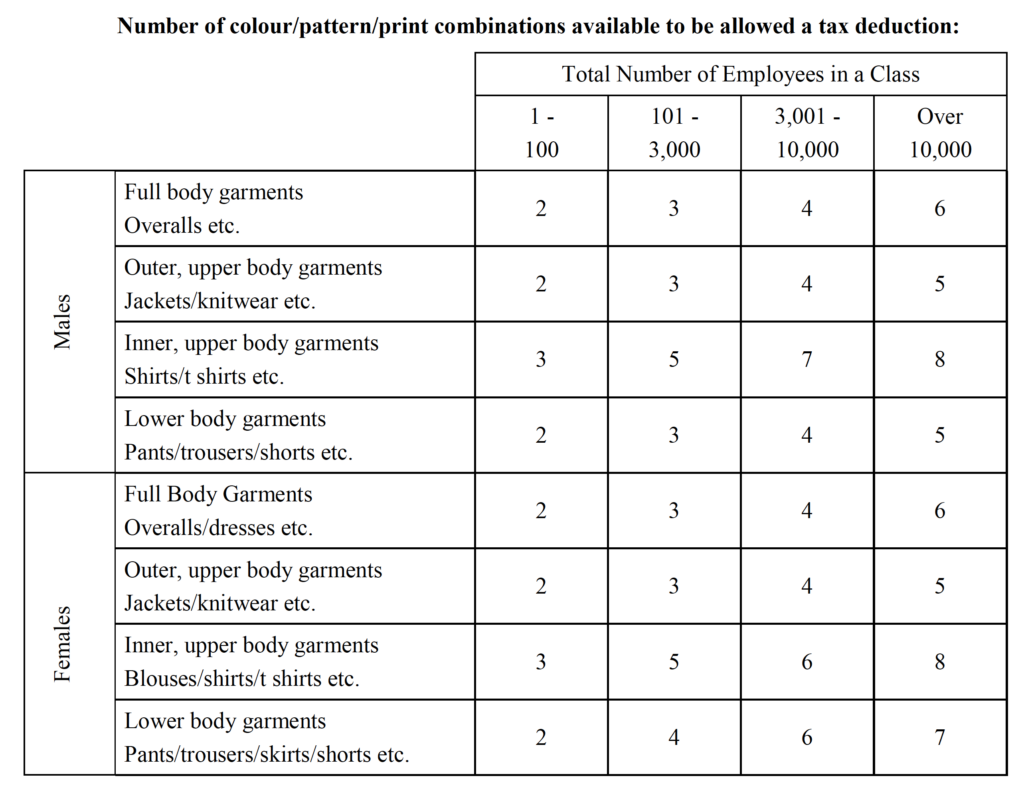

There is a limit to how many styles and colours can be included in your uniform program. Combinations must be relatively narrow so that it is easily identifiable as a uniform. There must also be one common colour for lower body garments to act as a common theme throughout a uniform set – and this colour must be worn by both men and women.

Image Source: Approved Occupational Clothing Guidelines 2017

Brand identifiers

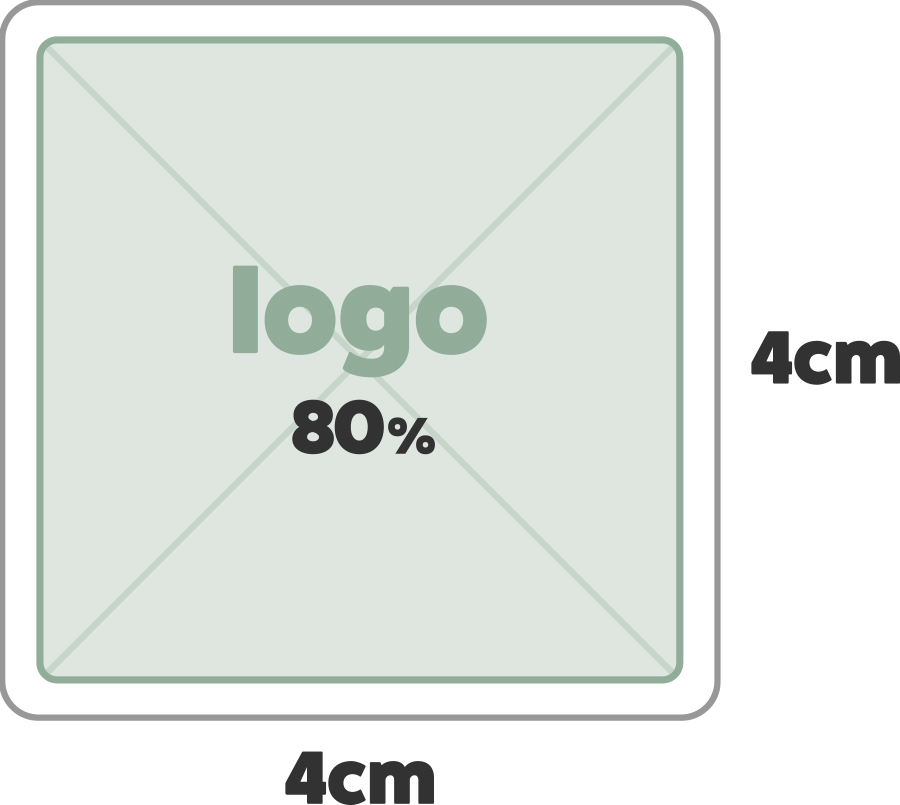

In terms of logo or branding, the identifier can be a standalone permanent logo (e.g. printed, embroidered or heat pressed) but MUST be at least 80% of a 4cm square area and clear from a distance of 2 metres. This means the identifier cannot be placed under a belt loop or be embroidered using the same colour as the garment in an attempt to “camouflage” it1.

In lieu of a logo, a “pattern identifier” may also be considered2. Any accessories (e.g. belts) included in the uniform set are also subject to the brand identification criteria.

For the full list of eligibility criteria, please visit business.gov.au or download the TCF Approved Occupational Clothing Guidelines here.

Once you have accurately determined that your business’s non-compulsory work uniforms are eligible for registration, the next step is to apply.

Here’s our guide on the application process:

- Complete an application form to have your uniform included on the Textile, Clothing and Footwear (TCF) Corporatewear Register – download here or via the business.gov.au website.

- Attach an embroidery sample – our team at Uniformity can assist you with this step.

- Submit your application via post.

If approved, a number will be issued to your business which can then be shared with your staff to provide to their accountant at tax time.

For any questions or assistance with any part of this process, contact our expert team at Uniformity today.

Disclaimer: The information contained in this article is general in nature and based on facts from business.gov.au. Any commentary relating in any way to tax is provided in the context of explaining the relevant process in relation to registering uniforms (or otherwise) and does not, in any way, constitute tax advice.

1 ‘Stand Alone’ Identifiers 23: The identifier must be in a contrasting colour or shade to that used for the item to which it is attached and be of sufficient size to be plainly visible to the casual observer from a distance of two metres. The employer, product or service depicted must also be easily identifiable from the same distance. The minimum size of stand-alone identifiers to be used are: (a) Clothing items: The stand alone identifier should be sufficient to cover 80% of a 4 square centimetre area (eg 2 cm x 2 cm, 1 cm x 4 cm etc.) This will allow identifiers of different shapes to qualify. (b) Accessories: The stand alone identifier should cover a 1 square centimetre area. These are minimum qualifications only, and the identifiers may be larger. A ‘stand alone’ identifier must be permanently affixed by being, for example, ironed on, sewn down on all sides, embroidered into, or printed onto an item of clothing. Detachable badges, pins, buttons and flag tags sewn into seams are not acceptable and will not qualify clothing for entry on the Register.

2 Pattern Identifiers 25: A pattern of identifiers, usually used as a print, may be used in place of a stand alone identifier provided that: (a) identifiers used in the pattern are, of a contrasting colour to the main background colour, a minimum size of 1 cm x 1 cm and there are a minimum of three such identifiers in an area of material measuring 15 cm x 15 cm; and (b) the employer, product or service depicted is easily identifiable from a distance of two metres.

read more

Uniform allocation vs allowance: how businesses can save up to 30%

Find out how allocating uniforms saves businesses up to 30% compared to offering a uniform allowance.

Discover our range

No Comments yet!